India’s quick commerce boom is quietly entering its second act. Behind the scenes, a new class of startups is building the sector’s invisible engine – managing dark stores, optimising inventory, and creating specialised delivery fleets. So, who is vying to become the new kingmaker of the 10-minute delivery revolution?

Building The Picks And Shovels: While consumer-facing platforms like Blinkit and Zepto focus on acquiring customers, these new ‘enablers’ are tackling the deep structural gaps in the value chain. These new entrants are taking end-to-end responsibility for fulfilment, from warehousing and micro cold-chains to last-mile logistics.

Here are some of the key players powering this shift:

- Inamo: Works with D2C brands to manage everything from order allocation to last-mile delivery.

- Blitz: Enables businesses to offer their own 60-minute delivery services

- Zippee: Powers 30-120 minute deliveries for D2C brands across 21 cities and manages three Lakh sq ft of dark store space.

Unpacking The Revenue Model: Enablers primarily operate on a pay-per-order or transaction-linked model, charging a percentage of the gross transaction value. An alternative is the managed-store model, which combines fixed management fees with performance-based incentives. While grocery, electronics, and beauty remain the most active categories, emerging segments like fresh produce and pharmaceuticals are creating new revenue opportunities.

Can They Fix The Economics? The core promise of these enablers is the claim of fixing quick commerce’s broken unit economics. Industry insiders estimate these emerging players can improve client profitability by 5-10% in the short term, with the potential to reach 20-30% as technology and automation mature. Beyond direct cost savings, their value lies in outsourcing the immense operational headache, allowing platforms to focus on building their brand and driving growth.

As these enablers build the critical infrastructure for instant commerce, can they transform the industry’s economics and become the next Delhivery or Shadowfax? Let’s find out…

From The Editor’s Desk Rapido’s Super App Ambitions Take Flight

Rapido’s Super App Ambitions Take Flight - The ride-hailing unicorn has now integrated travel booking services into its app by partnering with MakeMyTrip-owned Goibibo for flights and hotels, redBus for inter-city buses and ixigo-owned ConfirmTkt for trains.

- With this, Rapido wants to become a one-stop travel app. By leveraging its 50 Mn active users across 400+ cities, the Uber rival wants to onboard the next 100 Mn digital travel users, particularly from tier II and III markets.

- This expansion marks a significant step in Rapido’s evolution from a bike-taxi platform to something of a ‘super app’, which also offers auto and cab rides, and even food delivery through Ownly.

OPEN On The Mend In FY25

OPEN On The Mend In FY25 - The neobanking unicorn slashed its net losses by 35% YoY to INR 108.9 Cr in FY25, driven primarily by an 85% YoY surge in operating revenue to INR 45.9 Cr, a tighter leash on its expenses and a sharp improvement in its EBITDA.

- Founded in 2017, OPEN became India’s 100th unicorn in 2022 by targeting SMEs and startups with digital-first banking, payments, and financial management tools. It has raised over $250 Mn to date from names like IIFL, Temasek, and Tiger Global.

- India’s neobanking sector has been fraught with challenges. The lack of digital banking licences has forced players like OPEN to depend on traditional banks for core infrastructure, limiting their ability to monetise and incur heavy cash burn.

- Crypto exchange CoinDCX has secured an undisclosed fresh funding from existing investor Coinbase at a post-money valuation of $2.45 Bn, up from $2.15 Bn previously, signalling renewed confidence in the crypto unicorn.

- The funding comes just months after CoinDCX was hit by a $44 Mn hack, one of India’s largest crypto thefts. But what helped allay investor fears was the company’s 15% YoY jump in profits to INR 1.7 Cr in FY25 and a 43% YoY surge in top line to INR 559.6 Cr.

- For Coinbase, the investment aligns with its strategy of backing players in emerging markets to navigate complex regulatory landscapes. CoinDCX, meanwhile, is looking to capitalise on the recent crypto boom even as local regulations remain a work in progress.

Prosus Checks In At ixigo

Prosus Checks In At ixigo - Prosus has significantly increased its stake in ixigo, acquiring an additional 3.16% from Peak XV Partners in a secondary deal worth nearly INR 414.4 Cr. Simultaneously, early backer Elevation Capital offloaded 1.4 Cr shares for about INR 446.2 Cr.

- This comes days after ixigo’s board approved a fresh infusion of INR 1,296 Cr in the company from Prosus. If shareholders approve this, the Dutch investor will acquire an additional 10.1% stake in the online travel aggregator.

- Both Peak XV and Elevation Capital were early, pre-IPO investors in ixigo, and their recent stake sales are part of a planned exit strategy to book profits following the travel tech company’s successful public listing last year and recent profit run.

Matters.AI Lands Round For AI Data Security

Matters.AI Lands Round For AI Data Security - AI-native data security platform Matters.AI has raised INR 42 Cr in a seed round, co-led by Kalaari Capital and Endiya Partners, to fund its GTM strategy in North America and fuel R&D.

- Founded in 2023, Matters.AI positions itself as an ‘AI security engineer’ designed to help enterprises find, monitor, and secure sensitive data across complex cloud and on-premise systems.

- With 50 clients, including Groww and Nokia, the startup’s fundraise is timed with the impending implementation of India’s DPDP Act, which is expected to significantly expand the startup’s domestic opportunity.

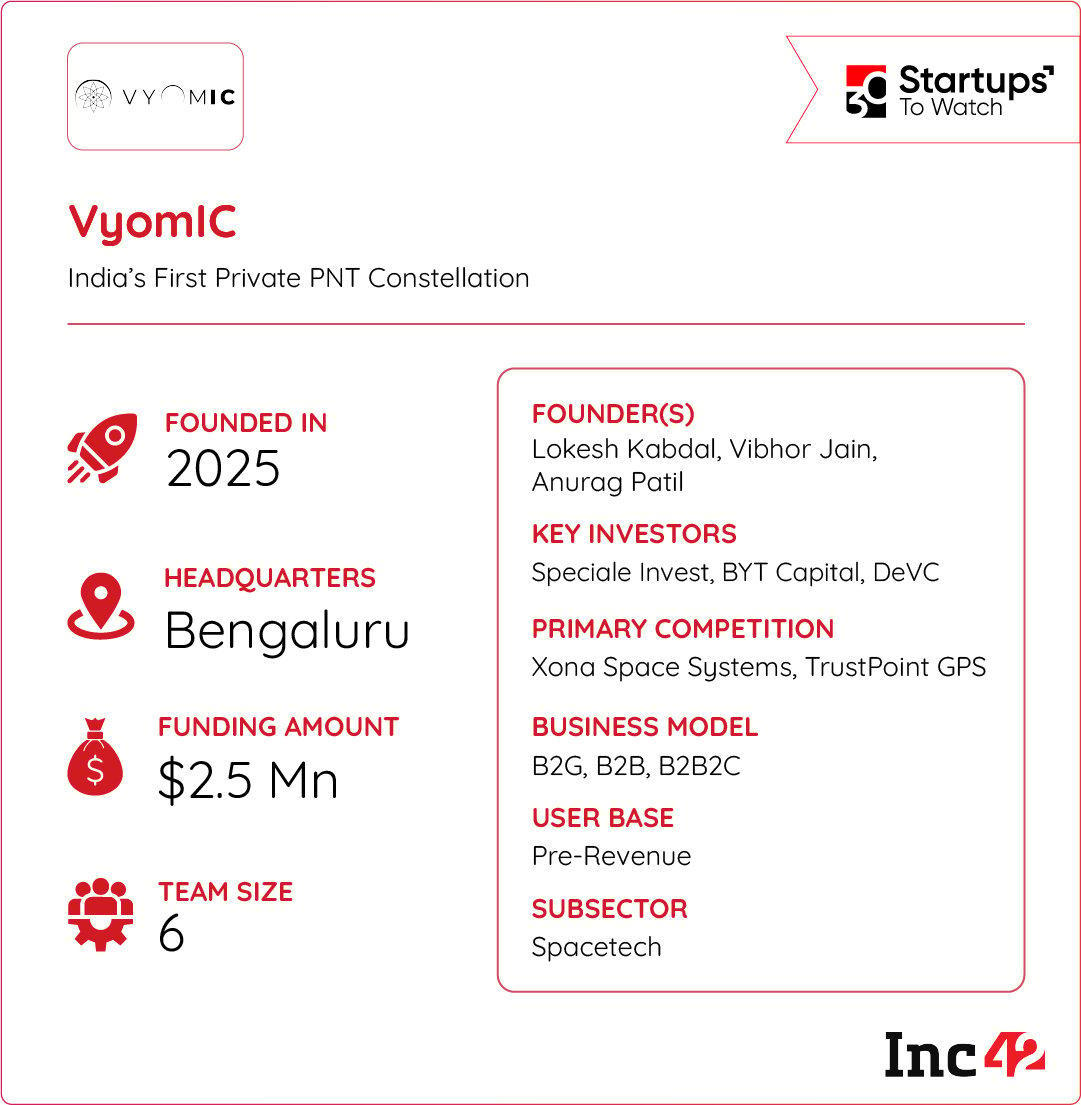

During a drone show in Gujarat, Avishkaar Hyperloop’s drones lost their link to the base station due to security jammers. This exposed the fragility of the traditional GPS systems to the founders of the startup. So, they sat down to build a new venture that would fix this problem.

Building A Resilient Navigation System: Founded earlier this year, VyomIC is building India’s first private global PNT (positioning, navigation, timing) satellite constellation. The startup wants to offer navigation that is far more reliable than current global systems, which often struggle with precision and are vulnerable to jamming or spoofing. VyomIC’s technology promises encrypted signals that are up to 1,000X stronger, enabling centimetre-level positioning accuracy.

A Global Opportunity: VyomIC’s revenue model combines hardware sales, subscription-based secure services, and public-private partnerships. Its systems aim to serve critical sectors such as defence, telecommunications, and autonomous mobility — areas where accurate and jam-resistant navigation is essential.

With an eye on the global PNT solutions market, which is expected to cross $5 Bn by 2033, can VyomIC build a sovereign and global navigation system from India?

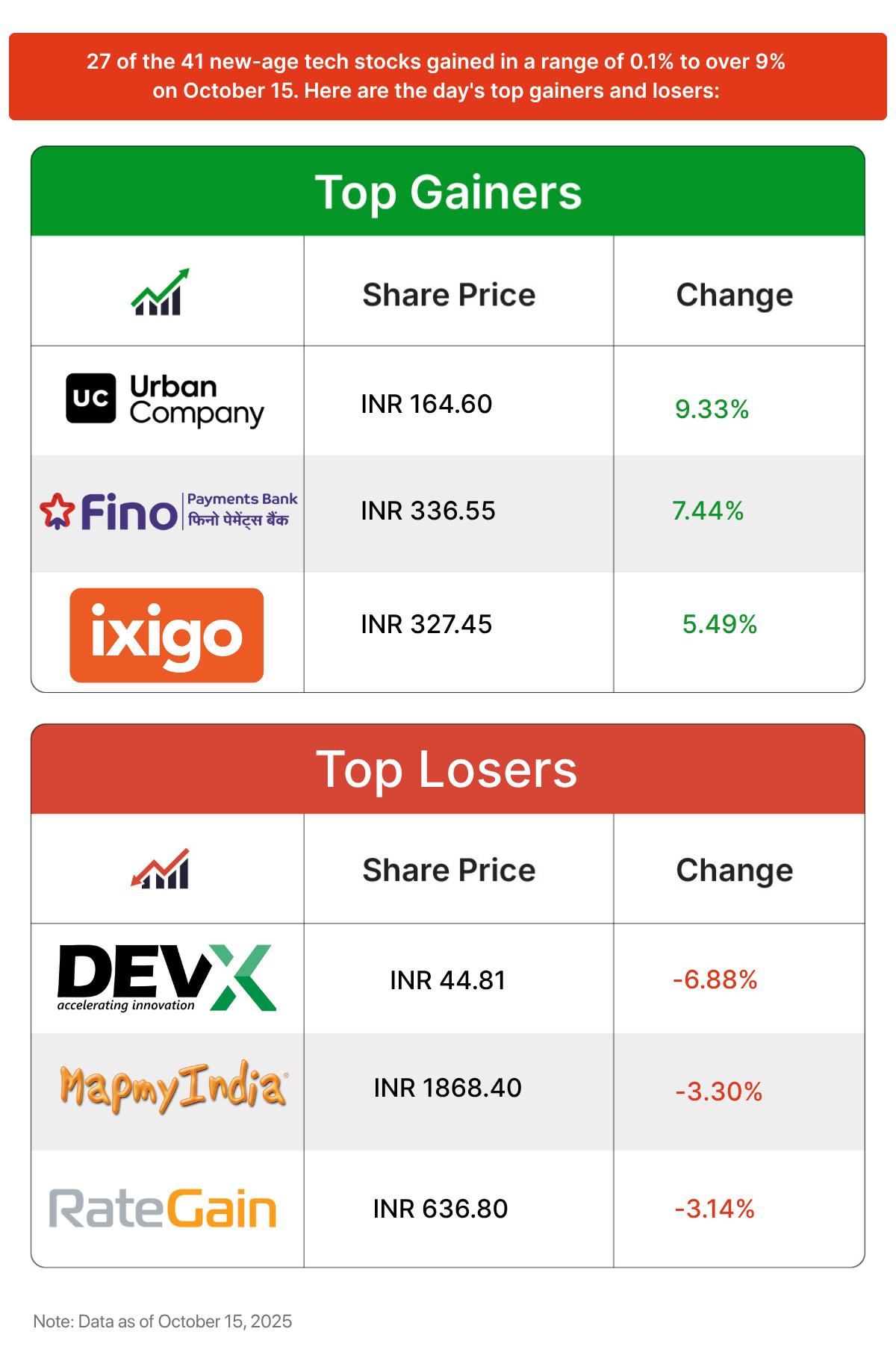

From Ola and PhonePe to boAt and Groww, more than 40 homegrown startups are gearing up to list on the D-Street, signalling a renewed rush of confidence in India’s new-age tech public markets.

The post The Quick Commerce Enablers, Rapido’s Super App Dream & More appeared first on Inc42 Media.

You may also like

Decades of enforced disappearances in Balochistan expose Pakistan's repression: Report

Karnal: Farmers adopt new techniques with special focus on stubble management

Sunteck Realty reports 34% rise in July-September pre-sales at Rs 702 crore

Toxic air: Delhi govt initiates Winter Action Plan for 2025-26 to check pollution spike

Pakistani airstrike in Balochistan kills six civilians as military operations escalates