The RBI recently floated its FREE-AI framework, a manifesto designed to guide the nation’s fintech sector towards building a strong, responsible and indigenous AI infrastructure. Here’s what the RBI’s AI vision looks like.

The 7 Sutras Of AI Age: In its 103-page report, the apex bank has proposed an INR 5,000 Cr corpus to create a shared data and AI compute infrastructure, as well as an AI sandbox for fintechs to experiment in a contained environment. Simultaneously, it has urged India’s BFSI sector to focus on fostering widespread AI adoption and building indigenous financial services-focussed AI models.

Despite the forward-looking vision, the RBI’s report has drawn a line in the sand – build it all, but do it under the ambit of an ethical and secure framework, called ‘Seven Sutras’.

- Trust

- People First

- Innovation Over Restraint

- Fairness And Equity

- Accountability

- Understandable By Design And Safety

- Resilience And Sustainability

The Great Divide: In the corridors of fintech, the applause is not universal. While industry leaders welcome the guardrails, they are wary of regulations stifling innovation and want more flexibility. Meanwhile, bank unions are alarmed and fearful that AI automation would fracture morale and leave a trail of job losses without a concrete plan for upskilling.

The Sovereignty Question: Looming heavily on the RBI’s AI vision is also the chasm between ambition and reality. The central bank’s dream of desi foundational models clashes with the high cost of building such LLMs. As a result, Indian banks continue to be reliant on foreign giants like OpenAI and Google, with no clear course of future action.

As India’s fintech sector stands at the AI inflexion point, can it balance innovation with responsibility and practicality? Let’s find out…

From The Editor’s DeskStartup Stocks Rally: Thirty-three out of the 36 new-age tech stocks under Inc42’s coverage gained in a range of 0.16% to almost 28% last week. Omnichannel jewellery brand BlueStone became the latest addition to Inc42’s list of new-age tech stocks.

BeepKart Shuts Down: The used two-wheeler marketplace has wound up operations after struggling with thin margins and high operating costs for years now. Mounting losses, haphazard expansion and poor service quality also led to the company’s collapse.

Startup Funding Takes A Hit: Indian startups cumulatively raised $62.2 Mn across nine deals last week, down 77% from the $272 Mn bagged across 18 deals in the preceding week. R For Rabbit and Kiwi topped the list by raising $27 Mn and $24 Mn, respectively.

Dream11’s Fintech Foray: The fantasy gaming giant’s parent has forayed into the investment tech space with the launch of Dream Money. The new platform allows users to invest in gold and FDs. This follows the passage of a new online gaming bill, which bans RMG in India.

CARS24 Nets INR 345 Cr: The auto marketplace’s Singapore-based parent has infused INR 345.2 Cr in the startup. The latest fundraise comes as CARS24 is doubling down on profitable verticals and downsizing loss-making entities ahead of its potential IPO.

Govt’s Chip Making Push: The Centre has committed nearly 97% (or INR 62,900 Cr) of the INR 65,000 Cr outlay earmarked for semiconductor incentives. This comes days after MoS IT Jitin Prasada said that India’s first homegrown chip will be rolled out by 2025-end.

Amazon Bats For FDI Exemptions: The ecommerce giant is lobbying the government to exempt exports from existing FDI restrictions. Current rules bar ecommerce platforms from stocking and selling goods directly to consumers. These restrictions also extend to exports.

India’s Neobanking Mirage: Once seen as fintech’s next frontier, the segment has now come to be defined by mass layoffs, a funding drought, and questions over its business model. So, what’s ailing India’s neobanking dreams?

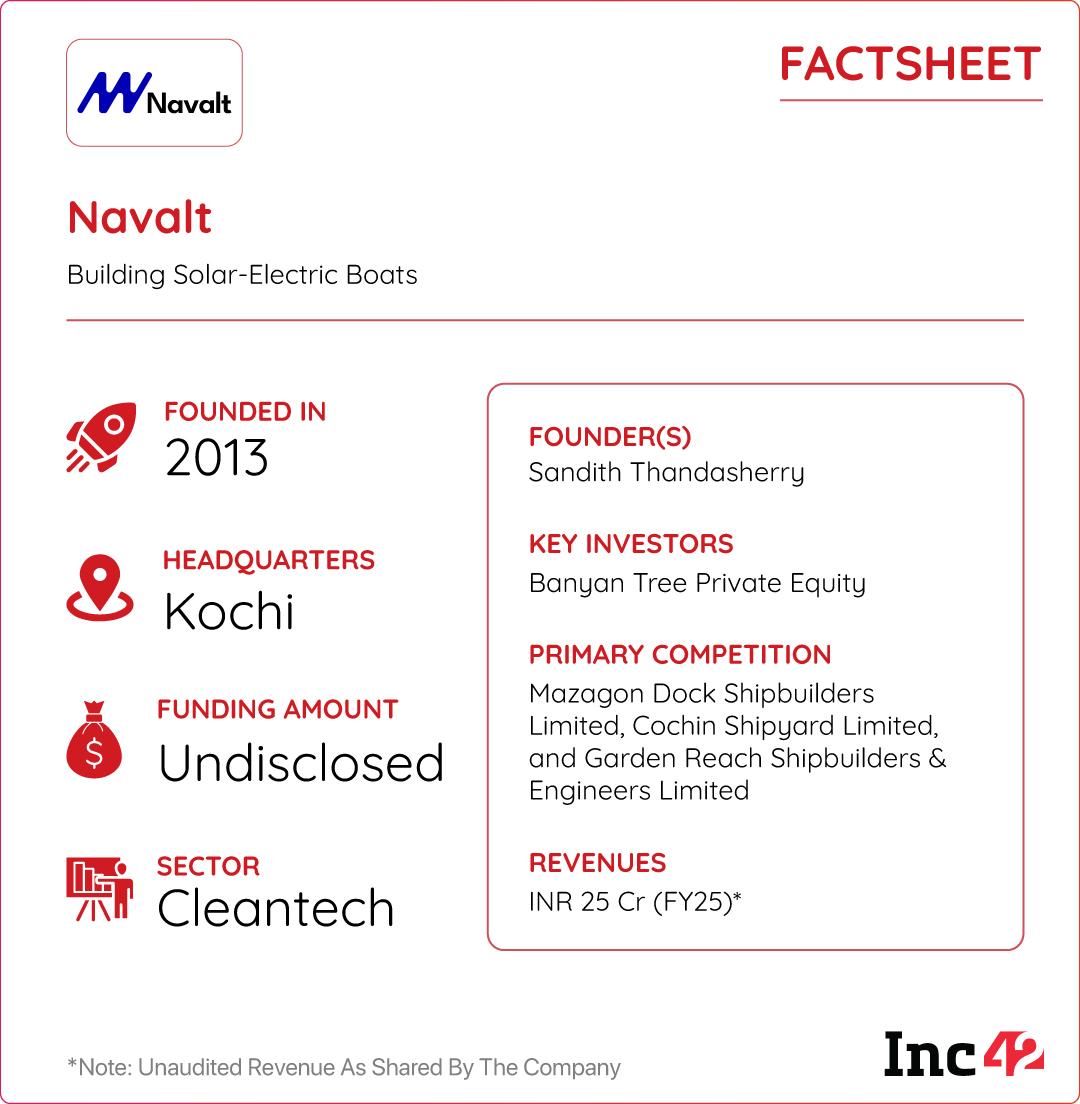

Inc42 Startup Spotlight How Navalt Is Steering The Boat Industry To A Cleantech FutureBoats are a way of life in Kerala, but the cost of maintaining them is a significant financial burden for operators. Enter Navalt, which claims that its clean energy-powered boats can bring down this operational cost by INR 35 Lakh annually.

Sailing On Sunshine: Founded in 2013, Navalt sells a fleet of solar and electric boats. By using lightweight materials and innovative design techniques, the startup has managed to create boats that require significantly less energy to operate. During the day, the boats run on solar power while the remaining requirements are topped up by lithium-ion batteries.

Its flagship passenger vessel, Aditya, claims to slash the operational cost of a ferryman by up to 35X compared to diesel-powered boats.

Can It Go Far? Beyond passenger boats, the Kochi-based startup also offers its fast boat, Barracuda, for defence purposes and RoRo boats for large vehicle transportation. Navalt plans to target the overall Indian shipbuilding market, which is poised to become an $8 Bn opportunity by 2033.

Looking to score more orders from the private and export sectors, can Navalt steer India’s boat-making into the clean era?

The post RBI’s AI Mandate, BeepKart Shuts Down & More appeared first on Inc42 Media.

You may also like

Hartalika Teej Fast: Which women should not keep the fast of Hartalika Teej? Know the rules..

Eight killed, 45 injured in Bulandshahr road accident, CM Yogi announces ex gratia

Retired IFS Officer And Wife Killed After Huge Tree Falls On Their Moving Scorpio In MP's Satna

Bigg Boss 19 Contestant Kunickaa Sadanand Calls Herself A 'Bad' Politician: 'Don't Care About Others' Opinions'

Apprentice Jobs: Lots of apprentice jobs in Naval Dockyard Mumbai, 8th and 10th pass can also apply..